Protocol Overview the Visa protocol is a standardized method used for processing Visa card transactions. It ensures secure data transmission between merchants, acquiring banks, and Visa’s payment network (VISA CLOUD).

Steps in Processing Funds Using Protocol 101.X

Transaction Initiation:

Customer: Provides Visa card details to the merchant.

Merchant: Sends an authorization request to their acquiring bank using a Visa Server.

Authorization Request:

Acquiring Bank: Receives the request containing transaction details (card number, approval code date, amount, etc.).

Verification: Checks the card's validity and performs fraud checks.

Forwarding: Sends the request to visa.com.

Visa Processing:

Visa Receives and processes the authorization request from the acquiring bank.

Visa Response:

Card Issuer: Verifies the cardholder’s account balance and performs fraud screening.

Response: Sends an authorization response back to Visa indicating whether the transaction is approved or declined.

Authorization Response:

Visa: Relays the card issuer’s response to the acquiring bank.

Merchant Notification:

Acquiring Bank: Forwards the authorization response to the merchant.

Merchant: Communicates the transaction result to the customer.

Clearing and Settlement:

Settlement: After the transaction, the acquiring bank and the merchant settle the funds, transferring money from the customer's card to the merchant's account.

This streamlined process ensures that Visa card transactions are secure, efficient, and reliable, benefiting both merchants and customers.

The Visa B2B Connect network enables bank-to-bank, cross

border payments between businesses. (https://usa.visa.com/partner-with-us/payment-technology/visa-b2b-connect.html)

Global payments through a single connection

Visa B2B Connect's multilateral payment network enables cross-border transactions directly between any banks connected to the platform for a more consistent and streamlined payment experience.

Legacy bilateral network

Bilateral networks like the one above often require multiple handoffs and handshakes between banks with disparate systems in distant locations before reaching the beneficiary—this can introduce delays, unpredictable costs, and inconsistencies in transaction data.

Visa B2B Connect multilateral network

As a multilateral network, Visa B2B Connect allows one-to-many global transactions to be sent directly between any participating banks, streamlining payments with greater transparency and predictability.

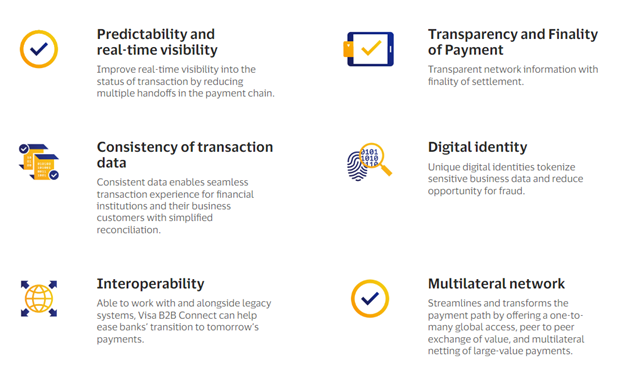

Transforming the cross-border payments experience

Visa B2B Connect addresses limitations in existing bilateral wire transfer systems, offering key benefits and an improved experience.